cumulative preferred stockholders have the right to receive

But the preferred shareholders will get no more than the 9 dividend even. A Common stockholders do not have the right to subscribe to a rights offering.

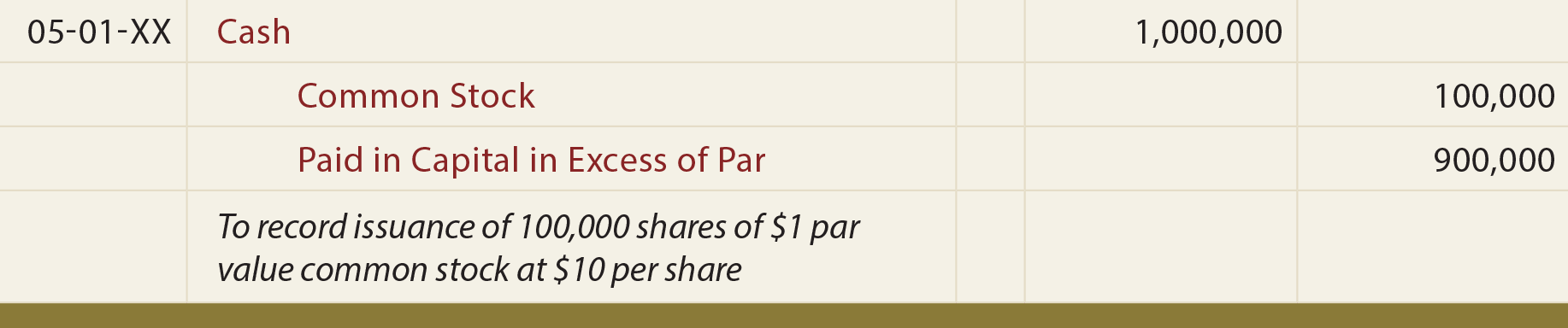

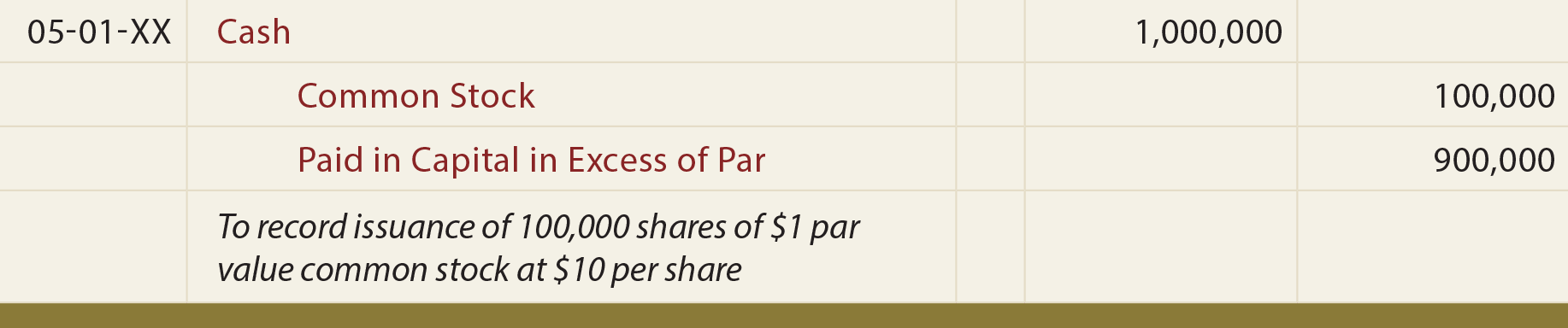

Common And Preferred Stock Principlesofaccounting Com

Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed.

. On the other hand preferred stock normally carries no voting rights. If a company is struggling and has to suspend its dividend preferred shareholders may have the right to receive payment in arrears before the dividend can be resumed for common shareholders. We review their content and use your feedback to keep the quality high.

Companies must pay unpaid cumulative preferred dividends before paying any dividends on. The _____ feature of preferred stock gives the preferred stockholders the right to receive current-year dividends and unpaid prior-year dividends before common stockholders receive any dividends. All the past omitted dividends are accumulated and assured to be paid.

Sufficient retained earnings Sufficient cash. B Neither common nor preferred stockholders have the right to subscribe to a rights offering. See also Bullish and Bearish Market Meaning Relevance and more How do Cumulative Preferred Stocks work.

The same shareholders have a right to claim any pending dividend payment the issuing company owes them. Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid. For example if ABC Company fails to pay the 110 annual dividend to its cumulative preferred.

Preferred stockholders have the right to receive dividends to strears those not paid in prior years promised prior to common stock dividends being paid. Preferred stockholders have the right to receive dividends before common stockholders. Creditors only have corporate assets to satisfy their claims.

This type of preferred stockis oled Cumulative preferred. Cumulative preferred stockholders have the right to receive adividends in arrears after common stockholders are paid dividends. The holders of these preferred shares must receive the 9 per share dividend each year before the common stockholders can receive a penny in dividends.

Cumulative preferred stock dividends that have not been paid in prior years. However preference as to dividends does not guarantee the payment of dividends. Furthermore in the event of liquidation participating preferred shareholders can also have the right to receive the stocks purchasing price.

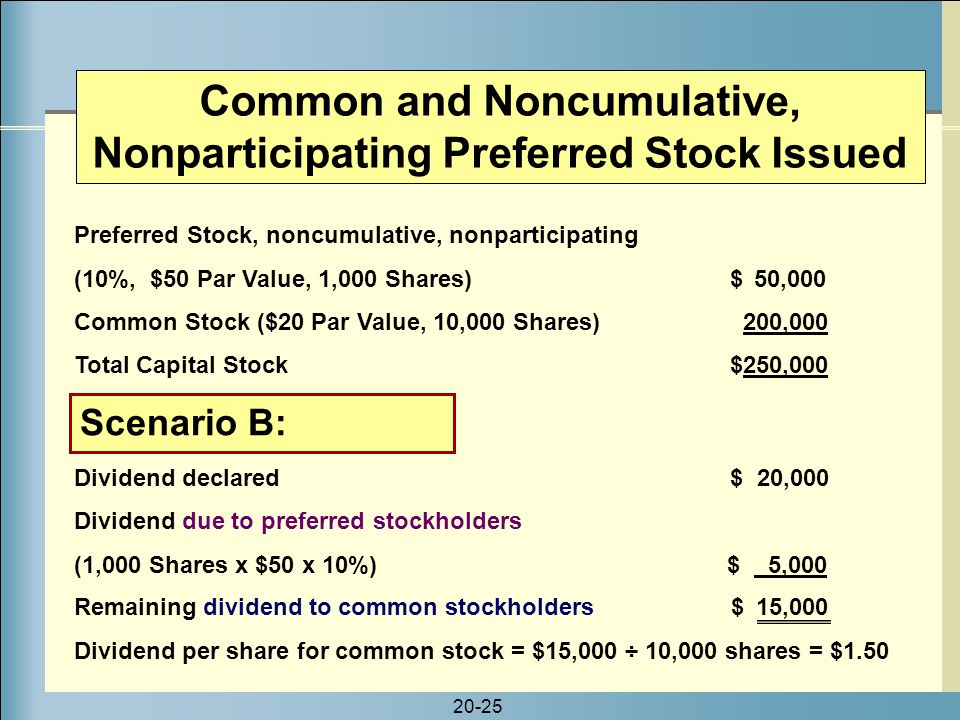

Companies often issue cumulative preferred shares as a source of long-term financing that helps the companies to raise considerable finance. Par value is an arbitrary meaningless value assigned to. Does not have the right to receive regular dividends that were not declared paid in prior years.

Who are the experts. The guaranteed dividend for these shareholders means that when dividends are in arrears this is a term that means when dividends are not paid out by the company cumulative preferred stock. The shareholders will receive the promised fixed amount whenever the dividends are declared.

Rather if dividends are declared the preferred stockholders have the right to receive their preferred dividend before the common stockholders are paid any dividends. Cumulative Preferred Stock stockholders have the right to receive dividends in arrears their regular dividends passed or not paid in previous years before common shareholders may receive a dividend. Preferred stock shareholders already have rights to dividends before common stock shareholders but cumulative preferred shares contain the provision that should a company fail to pay out dividends at any time at the stated rate then the issuer will have to make up for it.

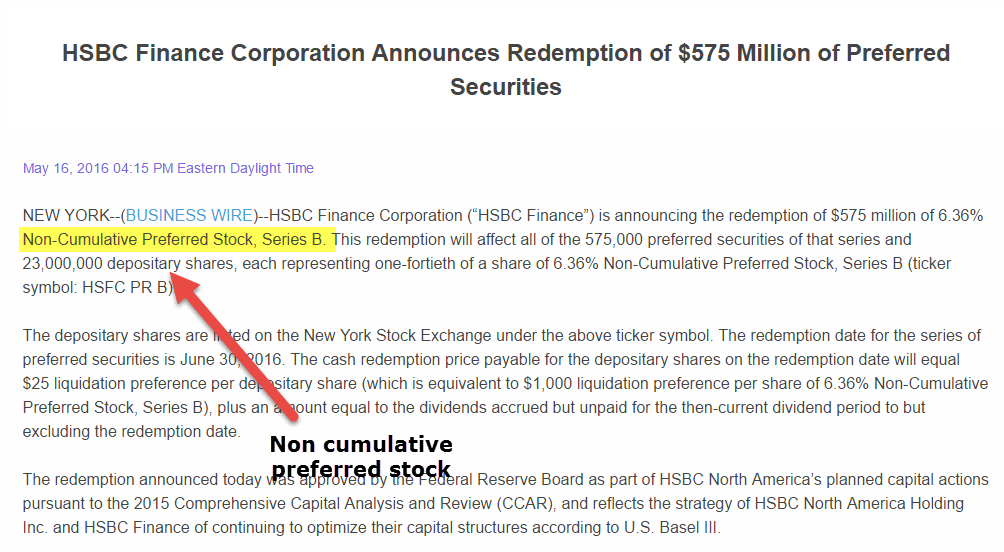

By contrast if a company issues noncumulative preferred stock its preferred shareholders have no future right to receive dividends that the company chooses not to pay. Cash distribution of earnings by a corporation to its stockholders. Cumulative preferred stocks are entitled to receive all the missed unpaid dividends.

C Both common and preferred stockholders have the right to subscribe to a rights offering. Priority preferred Preemptive preferred Dividends are not paid 10. Ba greater share of dividends than common stockholders.

It is a reliable source and is valued among investors. Cumulative Preferred Stockholders are entitled to their preferential right to receive dividends. DNone of these choices are correct.

This means that if the company does not declare dividends this year they do not have to pay preferred shareholders the guaranteed dividend amount. Experts are tested by Chegg as specialists in their subject area. D Preferred stockholders do not have the right to subscribe to a rights offering.

Cumulative preferred stock shareholders are treated differently because they have the right to receive a dividend whether one is declared or not. However in the case of cumulative preferred shareholders the company has an obligation of ensuring that such shareholders receive all their pending dividends. With cumulative preferred stock the company must keep track of the dividends it chooses not to pay to its preferred shareholders.

It means that cumulative preferred shares are important that the noncumulative. Investors who own cumulative preferred shares are entitled to any missed or omitted dividends. Cdividends in arrears before common stockholders are paid any dividends.

Common And Preferred Stock Principlesofaccounting Com

Cumulative Preferred Stock Definition

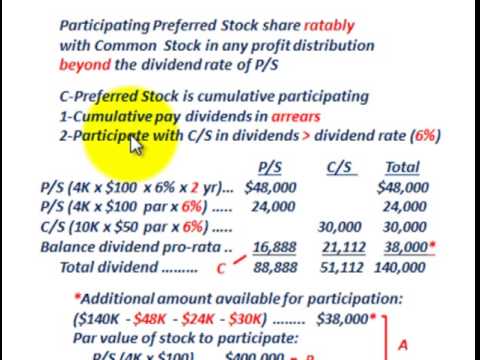

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Corporations Formation And Capital Stock Transactions Ppt Download

Cumulative Preferred Stock Definition Business Example Advantages

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

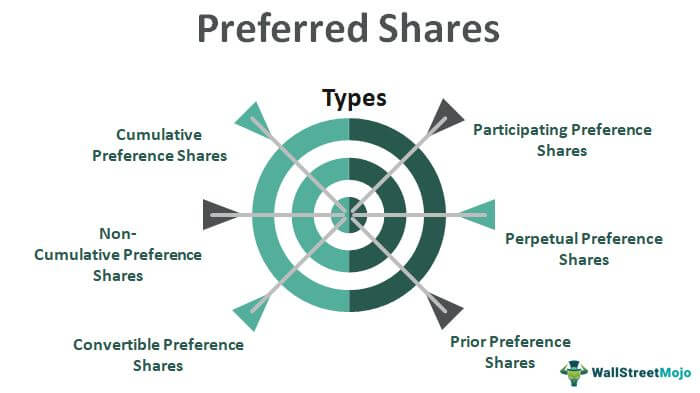

Preferred Shares Meaning Examples Top 6 Types

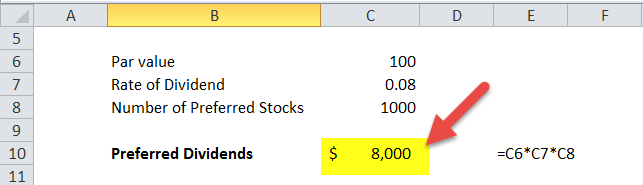

Preferred Dividend Definition Formula How To Calculate

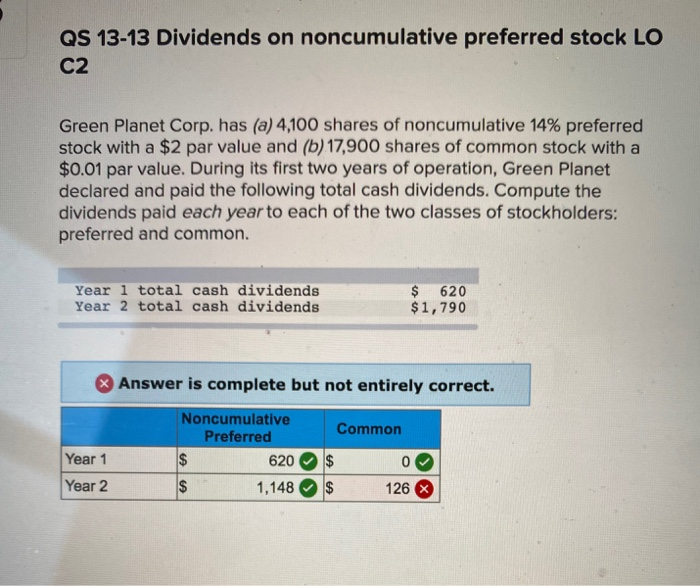

Solved Qs 13 13 Dividends On Noncumulative Preferred Stock Chegg Com

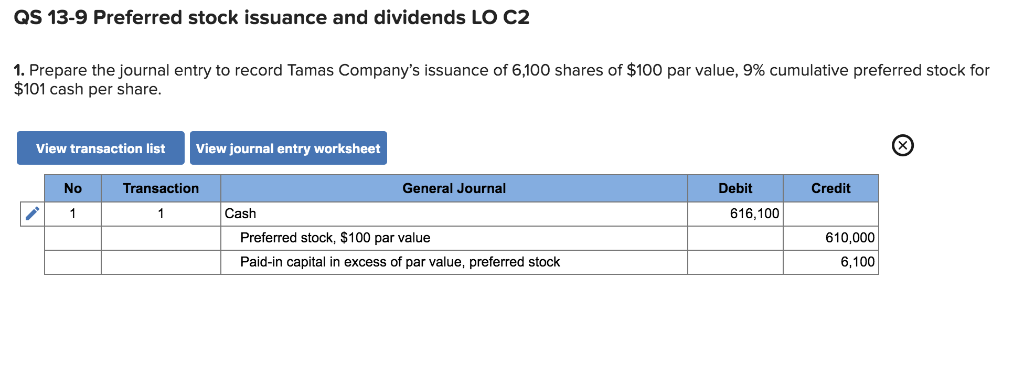

Solved Qs 13 9 Preferred Stock Issuance And Dividends Lo C2 Chegg Com

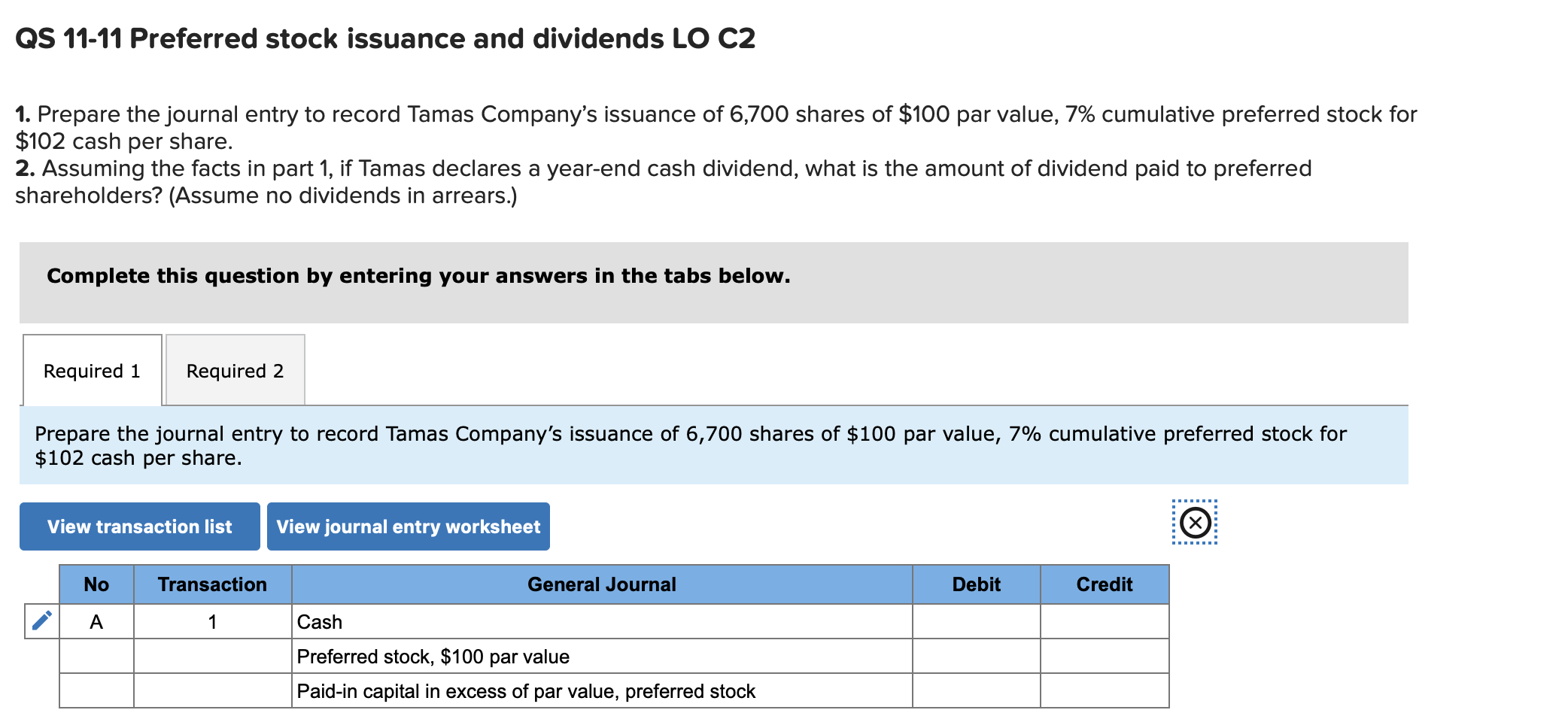

Solved Qs 11 11 Preferred Stock Issuance And Dividends Lo C2 Chegg Com

Preferred Stock Accountingcoach

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

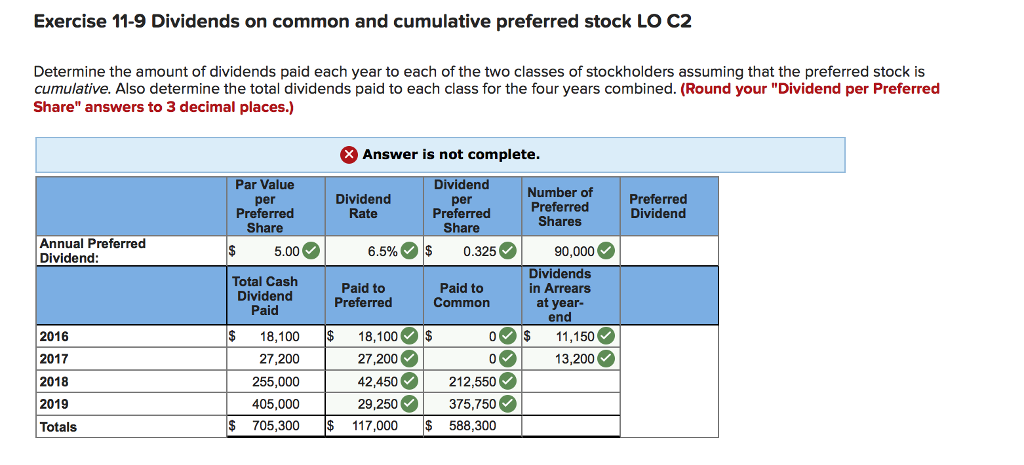

Solved York S Outstanding Stock Consists Of 90 000 Shares Of Chegg Com

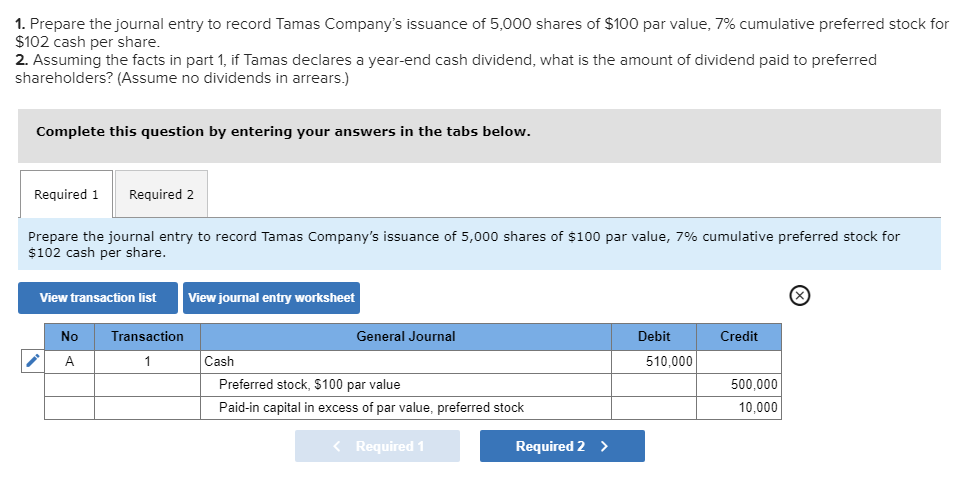

Solved 1 Prepare The Journal Entry To Record Tamas Chegg Com

Noncumulative Definition And Examples